Do you know why 9 out of 10 startups fail? They lose customers faster than they can win new ones.

To frame it in technical terms, their churn rate is higher than their customer retention rate.

Wait, but what is the churn rate? What is the customer retention rate?

Customer Lifetime Value definition

In marketing, customer lifetime value (CLV or CLTV) is also known as lifetime customer value LCV, or life-time value LTV. Customer Lifetime Value represents a prediction of the net profit attributed over the whole period of the relationship with a customer.

Customer lifetime value formula for SaaS

The following equation can be used to perform all calculations:

CLV = [0.5 * 1 / churn * (2 * ARPA + ARPA_growth * (1 / churn – 1))] * margin

*ARPA= Average Revenue per Account

SaaS Customer Lifetime Value in a nutshell

Churn rate, one of the Saas metrics, is the rate at which you lose customers. Customer retention rate is the composition of customers you are able to retain year after year. Needless to say, the lower your customer churn rate is, and the higher your customer retention rate is, the better it is for your business. They contribute to maximizing your customer lifetime value.

Customer lifetime value is an estimate of the net profit that the business will make in the future by continuing the relationship with the customer.

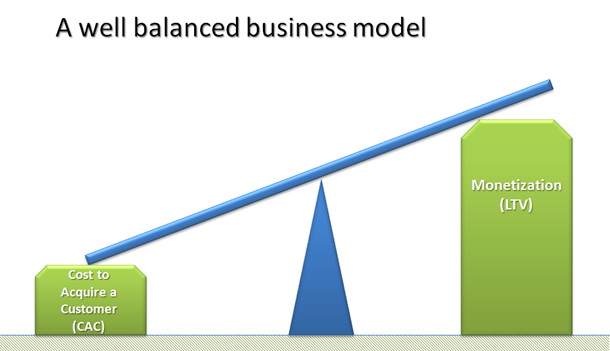

For any SaaS business, the annual subscription is what brings revenue. Hence, the cost to acquire a customer (CAC) must always be lower than the customer lifetime value. Otherwise, the SaaS business will run into a loss, like nine out of 10 startups.

David Skok of For entrepreneurs mentions in his insightful blog about CLV two thumb rules that can help SaaS businesses. They are:

- LTV > CAC. (It appears that LTV should be about 3 x CAC for a viable SaaS or another form of recurring revenue model. Most of the public companies like Salesforce.com, ConstantContact and so on have multiples that are more like 5 x CAC.)

- Aim to recover your CAC in less than 12 months, otherwise, your business will require too much capital to grow.

This image below from Skok’s blog summarizes these two rules.

Now, the tricky part is playing by these thumb rules. How do you recover CAC and how do you maximize customer lifetime value in cut-throat competitive marketing that is made up of customers with fleeting loyalty?

How SaaS Players Can Maximize Their Customer Lifetime Value (CLV)

In the SaaS space, or in any other business model, CLV plays a major role in steering the business forward. Unfortunately, not every SaaS business is enjoying a healthy CLV. They run into trouble after the conversion phase. Something happens after the conversion stage in the marketing funnel that makes the customer leave, let alone stay longer.

Finding the causes and fixing them is one way to maximize CLV. Another way is to follow the best practices that could help you improve your SaaS CLV gradually.

Want to know what those best practices are? Here are four of them.

1. Fine-Tune the Onboarding Process

First impressions matter, even in the SaaS business. Onboarding is the gateway for your customers to get a first-hand experience of your product in quick time. Recent estimates that 23% of customer churn happens due to poor onboarding. Poor onboarding even surpasses poor work relationship building and poor customer service as the top reason for churn rate.

So, fixing the customer onboarding process can do a lot to convince your customers to stay and maximize your CLV. Here are some actionable tips to fix your onboarding process:

- Keep it simple, fast, and easy.

- Include interactive videos, guided product tours, and so on.

- Personalize the onboarding by collecting user information beforehand.

- Conduct A/B testing to figure out the best onboarding process that makes customers stay.

2. Bank on Personalized Drip Emails

Email is a marketer’s go-to tool for meeting a prospect in their inbox. For SaaS marketers and businesses, it is no different. The only difference is that emails can be used in a slightly extended fashion, more like welcome drinks when you check-in at a hotel.

Welcome emails from the CEO, founder, or anyone important to the user who has just signed up makes a huge difference. If you want to ensure that your customers who read the mails continue using the product, use the mail to provide information that the user would be looking for.

For instance, most first-time users could be apprehensive about the pricing, using the SaaS tool, its security prowess, and so on. Personalized drip emails that provide information can be used to put customer doubts to rest. Also, it can be used to educate customers about the many ways how they can better use the product for maximum benefit.

Instead of sending cold welcome emails include additional information like:

- Links to important knowledge base articles about using the product.

- Blog links that can give them more insights about the product.

- Sharing case studies of customers who are using the application in innovative ways.

Through emails, all this type of information can make the customer stay longer and help maximize the customer lifetime value.

3. Champion Omnichannel Customer Support

Let’s face it. There is no better way to win and keep customers than to provide them with world-class support. In today’s omni-device world, customer support must also be omnichannel.

Omnichannel customer support means to provide customer support via all channels including email, phone, social media, mobile app, live chat, chatbots, and so on. In fact, live chat support is considered to be the most popular and customer satisfying support channel compared to email and phone. Live chat software can help businesses attend to several customers simultaneously without having to ramp up their contact center resources.

4. Seek Customer Feedback for Improvement

Improving customer lifetime value is a never-ending process. One must always go back to the whiteboard to figure out new ways to make the product better, streamline workflows, and make lives easier for customers.

Sometimes, instead of DIY, it is better to ask customers for feedback. Since they are the first-hand users of the product day in and day out, they ought to have suggestions that can turn around the product for good. Inputs like which features need to be added, what needs to be improved, and what needs to be chucked can all be learned by seeking feedback from customers.

And, don’t just stop with collecting feedback. Act upon them! Showing that you not only collect feedback but also act on them is a sure sign that your business cares for customers. That gives fleeting customers a good reason to stay longer.

Bringing It All Together

There is an old statistic that will never go out of style. Increasing customer retention rates by 5% increase in profits by 25% to 95%. A research done by Frederick Reichheld of Bain & Company validated this point.

That said, maximizing customer lifetime value is crucial for any business. More so for the SaaS business model where customers have the flexibility to terminate a service instantly. To make them stay and not churn out, the best practices discussed above should help.

Frequently asked questions

1. How do you calculate the lifetime value of a SaaS customer?

To calculate the lifetime value of a SaaS customer, you can use this formula:

CLV = [0.5 * 1 / churn * (2 * ARPA + ARPA_growth * (1 / churn – 1))] * margin, where ARPA represents the Average Revenue per Account.

2. What is LTV SaaS?

The lifetime value of a SaaS customer is defined as a predictive metric for the net profit a user/customer brings to the company over the entire relationship between the two of them. For a Saas business to be profitable, the cost of acquisition must be lower than the lifetime value of that customer.

3. How do you calculate lifetime value?

If you want to calculate the historical customer lifetime value, the formula you can use is CLV = (Transaction 1 + Transaction 2 + … + Last transaction) * Average gross margin. If you want to find the predictive value of this metric, the formula is CLV = CLVs * Monthly retention rate1 + Monthly discount rate – Monthly retention rate.

4. What is a good LTV CAC ratio for SaaS?

The LTV value must always be higher than the CAC for a SaaS to stay profitable. SaaS companies have a subscription-based business model. For a good LTV to CAC ratio, the LTV should be at least 3 X CAC. Ideally, your SaaS company is able to recovery CAC within 12 months or you will need more capital to generate growth.