Who brings in the most revenue for your company? Which customer is costing you the most? Are those customers that cost a lot worth it? Or are you wasting your resources catering to shoppers who aren’t even bringing considerable profits? All these answers (and many more) reveal themselves to you at the end of a successful Customer Profitability Analysis (CPA). Understanding Customer Profitability is an excellent step toward becoming more profitable in the long term.

This blog post will highlight this fantastic tool, including its formula, benefits, and the mindset you need to improve it.

Key Takeaways

- Definition of CPA: CPA involves determining the profitability of each customer by attributing specific revenues and costs to them over a certain period. This management accounting tool helps identify which customers contribute most to profits and which may be less profitable or even unprofitable.

- Benefits of CPA: Implementing CPA enables businesses to prioritize retention efforts by segmenting customers based on their profitability. This approach allows for targeted strategies to enhance customer value and overall profitability.

- Challenges in Implementation: Accurately measuring costs associated with individual customers can be complex. Additionally, CPA is retrospective, analyzing past events, which may not always predict future profitability, especially if market conditions change.

- Strategies Based on CPA Findings: Businesses can develop tailored strategies for different customer segments identified through CPA. For instance, focusing on retaining highly profitable customers, transforming unprofitable yet strategically important customers, or reconsidering relationships with customers who consistently generate losses.

- Integration with Customer Lifetime Value (CLV): While CPA provides a historical view of customer profitability, integrating it with CLV offers a forward-looking perspective. This combination helps in forecasting future customer profitability and informs strategic decisions aimed at long-term growth.

What Is Customer Profitability Analysis?

Customer Profitability Analysis (CPA) is finding the profitability of each customer (or customer segments) by attributing profits and costs to each separate customer (respectively, each segment) over a certain period.

According to the Customer Profitability Analysis definition, CPA is more of a management accounting tool than a marketing strategy.

Benefits of Customer Profitability Analysis

Evidently, profitability is the endgame for your business, and there are multiple ways to increase your net margin. Some companies decide to focus on the first part of the journey and pump more prospects into the funnel, hoping to increase their profits.

However, with the current surge in acquisition costs, you might find that acquisition is not necessarily sustainable.

After all, it’s not 2019 anymore.

When the acquisition isn’t returning a satisfying ROAS, the other approach to reducing marketing costs is getting your newly acquired customers to spend more with your store. I.e., increasing Customer Lifetime Value and growing in a predictable, healthy way.

- CPA empowers you to better prioritize your retention efforts.

With Customer Profitability Analysis, you can divide your customer base into customer segments based on the value each customer generates.

This segmentation is an advanced segmentation technique, also known as RFM (Recency, Frequency, Monetary value), that allows you to concentrate your efforts where it matters the most.

Of course, no one says you should completely ignore low-value customer segments. Yet, when resources are scarce and operations costs are getting higher and higher, it’s wise to direct your attention toward more profitable segments.

When you segment your customers by profitability, you discover low-value groups that cost you more than they bring in. It’s common sense to let these customers loose and not stress too much over retaining them – freeing up your resources for power customers.

- CPA optimizes your marketing strategies.

Besides helping you eliminate (or simply let the natural customer churn occur), with CPA, you can update your marketing efforts by looking at your data.

After identifying high-profit customers, you can conduct qualitative and quantitative research to uncover their traits, motivations, and needs. You can adjust your messaging, communication channels, and paid media strategy with these valuable insights.

This step aims to uncover as much information as possible about your most profitable customers, then work on attracting similar high-revenue customers.

- CPA helps you with customized retention strategies.

Analyzing customers and their value empowers you to do more than the bare minimum with your retention efforts.

Some businesses bribe their customers with discounts and vouchers without considering their wants and needs.

Different types of customers require various incentives – and as we discussed earlier, some of them aren’t even worth retaining. Customer Profitability Analysis gives you a better image of the costs involved in building customer loyalty and how much you can afford to spend on retention.

Use CPA to tailor your retention strategies according to customer value.

Higher-profit customers will get the highest quality services. Even if customer service costs are higher, they will pay off in the long run when you see your investments returning.

- CPA helps you optimize and even reduce costs

A crucial step in CPA is determining how much each customer is costing you in customer service, marketing, and even product delivery.

Of course, this insight is invaluable, as it shows you how much you spend in order to earn.

A firm understanding of your costs enables you (and your teams) to identify opportunities for cost optimization.

For example, companies offering free shipping in remote areas might find that those customers aren’t so valuable – as they don’t bring in much revenue. So, they can optimize the costs by not covering the delivery anymore and offering other perks, like discounts for future purchases.

Or you might find that specific customer segments cost you more in customer care, but they don’t bring as much value as other segments.

This way, you can cut costs by offering alternative ways of contacting you without getting through an agent or prioritizing the tickets coming from high-value customers.

How Do You Calculate Customer Profitability?

So, you’re now convinced to calculate customer profitability and use the findings to adjust your customer segmentation, marketing strategies, and retention techniques.

Let’s move on to the customer profitability formula and bring more light to this fascinating tool.

Customer profitability formula:

Total annual revenue generated – Total costs included.

In other words, you deduct the costs of acquiring and retaining the customer from the total revenue generated by said customer.

It’s essential to only include costs that you can directly attribute to a single customer. Don’t include operational or logistical expenses like rent, utilities, or manufacturing.

Suppose your eCommerce business sells $350 in products to a particular client monthly while also spending an average of $300 in acquiring and keeping the said customer. In this case, the formula would look like this:

CPA = $350 – $300

CPA = $50.

This is the best-case scenario, where profitability is positive. But now, let’s look at the alternative.

You spend approximately $400 in acquiring and retaining a customer who spends an average of $150 on your brand. In this case, the formula reveals a fascinating insight:

CPA = $150 – $400

CPA = $-350

The CPA is negative, so this customer is a low-profit customer. This means you can either get them to spend more and push them into a power segment or refocus your efforts on customers with positive CPA.

How to Do Customer Profitability Analysis

The cornerstone of measuring customer profitability and analyzing it is segmenting your customers and attributing costs and revenue according to each segment.

The biggest misconception in CPA is that every customer is the same. Companies that look at profitability analysis as an average won’t succeed in improving customer profitability because they will go for “one-size-fits-all” solutions.

However, suppose you understand that not only customers but products also are different, each with their corresponding value. In that case, you’re on the right track to successfully analyze your Customer Profitability.

Step 1 – Establish your communication channels.

Performing a Customer Profitability Analysis starts with looking at your communication channels and touchpoints where customers can interact with you.

Once you get a complete view of all the channels where customers interact with your brand, you can evaluate the costs of each channel.

For example, your costs might include:

- Marketing spending

- Social Media Ads

- Email subscriptions

- SMS campaigns.

After you finish listing all touchpoints, you can move further to the next step – the critical element of your strategy.

Step 2 – Set up Customer Segments.

What types of shoppers do you have, and why do they buy from you?

Whether you break your customer base into smaller segments based on customers’ behavior or use empirical data (customer age, income, area, etc.), customers need to be divided into specific groups.

You already know that personalization is the ace up your sleeve in eCommerce. People love to be seen and feel special, so individual attention is highly sought nowadays. If you segment Customers, it will be easier to kick off personal treatment for each customer since you already have more insights about them.

Besides customer experience, segmentation helps you get precise results with your CAP. So your future business decisions can be data-driven.

Step 3 – Attribute Costs and Revenue.

Now that you have your segments, it’s time to determine the revenue for each segment.

Don’t forget to consider adjustments like discounts, fees, and service charges. Calculated profitability is only accurate when you look beyond the average and consider all revenue segment changes.

The other side of this step is calculating each segment’s cost. When considering costs, ensure to include service & distribution costs as well as sales & marketing costs.

While many ignore service & distribution costs, they’re crucial for accurately determining the cost attribute.

Hint – your data might not be laid neatly in a single place or attributed to each individual customer. You might find costs grouped into different departments or your revenue spread over multiple platforms.

Use a Customer Data Platform like Reveal to gather all your zero and first-party data in an easy, accessible way and get priceless insights at a glance. Read more about Reveal here.

Step 4 – Determine your metrics.

Now that you have all the pieces, you need to determine which metrics prove your customers’ successes with your brand.

For example, you can look at ticket volume and determine whether particular customers are costing you more money in customer service. Connect the costs with their revenue and determine whether these customers are cost or profit centers.

Another essential metric is in your marketing department.

The costs per transaction show you if the money you spend on acquisition is worth it for particular customers or if you’re just bleeding your budget over low-quality customers.

Look at all metrics your company tracks regarding product performance, customer experience, sales & marketing, and see which are related to cost/revenue.

Now, you should have a list of metrics that can be associated with the customer profitability analysis:

- Costs to bring in a new order

- Return rate

- Shipping costs

- Customer Service costs

Step 5 – Blend them all together.

So, you know where you spend your money, who is bringing in your revenue, and how to track profitability.

Now it’s time to hit play, put them all in action, and run the revenue/ costs for each customer group and individual customer.

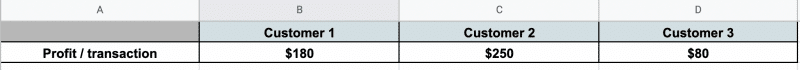

Here’s a Customer Profitability Analysis example (multiplied for each customer, of course):

With this information, you know that Customer 2 is a valuable customer that brings you more money than Customer 3, who isn’t necessarily a power customer inside your business. You stand to lose more if Customer 2 churns than if Customer 3 leaves you.

Now that you have this new knowledge, you can adjust your strategy, budgets, and product assortment to deliver better customer experiences to Customer 2.

How to Improve Customer Profitability

Of course, any metric can be improved to help a business grow, and Customer Profitability is one of them.

The most obvious idea to improve customer profitability is to determine your customer rockstars, i.e., the most profitable customer group. Then focus your resources on maximizing the revenue generated by this power group.

Kick-off customer retention strategies to keep these customers engaged and loyal and allocate more resources and budgets to meet the requirements of this segment.

Don’t mistake this idea for completely ignoring less profitable customer segments. You can also help them become more profitable by lowering the costs associated with these segments or persuading them to buy more and bring more revenue.

Leverage your insights from your revenue/costs analysis and identify the root cause of the lack of profitability with lower segments.

Like what you're reading?

Join the informed eCommerce crowd!

We will never bug you with irrelevant info.

By clicking the Button, you confirm that you agree with our Terms and Conditions.

The truth is, Customer Profitability can’t be improved with a few tweaks or by pushing more people into the acquisition stage of the funnel.

With Customer Profitability, you must adapt and evolve your organization’s mindset and attitude toward the customers.

After all, the customer experience is the current currency and what separates leaders from followers in eCommerce.

Your success depends on how you treat and engage your customer before, during, and after a purchase.

That being the case, it’s time to align your sales, marketing, and customer experience departments with the new mindset of customer centricity – otherwise, the whole process will succumb to its knees.

CPA is an organization-wide, cross-department responsibility and can’t function on the pillar of one department alone.

It’s useless for your marketing teams to optimize costs and deliver laser-targeted emails if the Customer Experience department doesn’t treat the power-customer right.

What happens when you don’t have the resources to kick off organizational changes?

Start small. Focus on a single product category, an individual revenue stream, or a single customer segment, then expand as you can.

Even small pilot projects can add and generate revenue in the long term. And evidently, 1% is better than 0%. Starting small is infinitely better than doing nothing at all.

Wrap-up

Customer Profitability Analysis (CAP) gives you a firm grasp on how much revenue you get from each customer, how much each customer costs, and where & why customers are costing you the most.

Analyze Customer Profitability, and you’ll be armed with invaluable information.

With these insights, you can (and should) hold on to your best customers and turn less profitable relationships into improved ones.

Frequently Asked Questions about Customer Profitability Analysis

How do you analyze Customer Profitability?

To determine Customer Profitability you need to deduct the costs of acquiring and retaining the customer from the total revenue generated by said customer. Ideally, you would segment your customers, so the analysis is more precise: you know exactly who’s bringing your profits and who is actually costing you money rather than bringing in revenue.

What is the use of Customer Profitability Analysis?

Customer Profitability Analysis (CAP) gives you a firm grasp on how much revenue you get from each customer, how much each customer costs, and where & why customers are costing you the most. With these insights, you can retain your best customers and turn less profitable relationships into improved ones.

What are the factors of customer profitability?

Customer profitability is influenced by various factors, including revenue generated by the customer, costs associated with serving the customer, and the length of the customer relationship. Key factors affecting customer profitability include customer acquisition costs, the frequency and value of customer purchases, the cost of goods sold, marketing and advertising costs, and customer service and support costs.

Why is Customer Profitability Analysis important?

Customer Profitability Analysis is important because it allows businesses to prioritize their efforts and resources based on the profitability of different customer segments. It helps identify which customers contribute the most to the company’s bottom line and enables businesses to focus on nurturing and retaining high-value customers while optimizing resources allocated to less profitable segments.