Sometimes, keeping an eye on the leading indicators of churn is not enough. No matter how precocious you are about churn, you need to perform customer churn analysis regularly.

You might be dealing with problems that you didn’t discover through other types of analysis. The sources of last year’s churn might be different from those currently driving rising churn rates.

Customer churn rate analysis helps you stay aware of why customers leave and act effectively to eliminate churn that you can avoid. Also, analyzing customer churn allows you to improve your product assortment, customer experience, and eliminate friction all together.

Let’s dig deeper into customer churn analysis to understand its role and importance to your eCommerce business’s health.

What Is Customer Churn Analysis?

Customer churn or customer attrition represents the metric that determines the percentage of customers that stopped buying from your store during the analyzed period.

Churn can occur at any stage of the relationship, after a single purchase or even after repeat purchases.

Customer churn analysis helps you understand the underlying reasons behind your store’s churn rates. It goes beyond calculating your churn rate and enables you to identify the factors that lead to customer churn and use this knowledge to reduce the risk of churning.

Calculating and tracking churn rates should be an ongoing process.

Churn analysis reveals anomalies in your customer database evolution that you can further investigate through qualitative research. All these steps contribute to improving retention in the long run.

How to Calculate Customer Churn

You want to calculate the churn rate to know the percentage of customers that stopped buying from your online store in a specific timeframe.

The formula that helps you calculate the churn rate is:

Churn Rate = (The number of customers you lost in the period / The number of customers you had at the beginning of the period) X 100.

How often will you calculate the churn rate?

Your churn metrics depend on the types of products or services that you are selling, but also on the type of customers in your customer base.

If you’re offering something that customers are buying monthly, it’s healthier to track churn on a monthly basis. If the average period between transactions goes beyond one month, you should at least track the yearly churn rate.

Let’s say your store is selling pet supplies, and you started the year 2021 with 23,000 customers and a yearly churn rate of 2.5%. By the middle of 2021, you had 23,300 customers, but by the end of the year, the numbers dropped to 22,400.

The churn rate for the entire year was 2.6%, while the churn rate in the last six months increased to 3.8%.

If you stopped measuring churn rate in the middle of 2021, thinking that your customer base is growing and your marketing efforts are paying off, you wouldn’t notice the negative trend from the last two quarters.

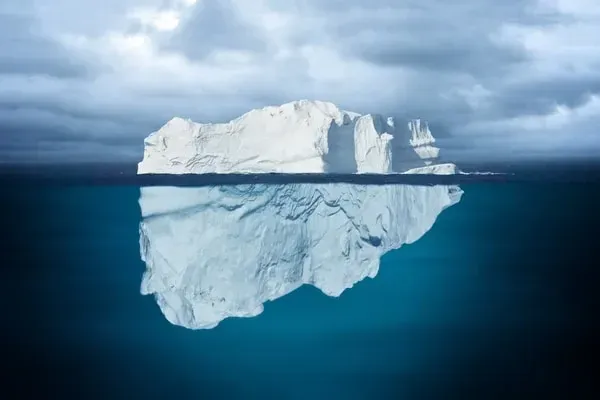

By conducting a churn analysis, you can see beyond the tip of the iceberg and identify the causes of the higher churn rate.

For example, one of the causes of churn in the last six months could be the active churn of dissatisfied customers that didn’t receive the proper treatment from your customer support teams. Another could be the passive churn that occurred due to a technical payment problem that your marketing and development teams didn’t notice in time.

> Are you struggling with many at-risk customers? Learn how you can reactivate customers that are about to leave you.

Importance of Customer Churn Analysis

The ugly truth about not aligning with what your customers need and expect from your brand is that they won’t necessarily complain before leaving. Most customers leave silently after one or multiple purchases, so measuring churn means measuring damage that already happened.

Many companies with new customer acquisition as their top priority don’t notice churn until they deal with reduced revenue and decreasing profit.

When a company reaches this point, it’s already in big trouble.

There are multiple leading indicators of churn that you should monitor, such as purchase frequency, customer satisfaction scores, engagement metrics, or reviews.

Churn analysis allows you to evaluate the current situation and elaborate a plan that will help with churn prevention and keep your business away from worst-case scenarios.

Like what you're reading?

Join the informed eCommerce crowd!

We will never bug you with irrelevant info.

By clicking the Button, you confirm that you agree with our Terms and Conditions.

By calculating churn rate for different timeframes, you can identify the problematic periods. Also, you can go in-depth with a qualitative analysis that will help you understand the “why”.

Usually, customer churn analytics function best when you’re asking questions like:

- Why did we have a great BFCM campaign, but the churn rate boomed the following month?

- Why did we lose 20% of our loyal customers in the last 12 months?

- Why did we have 350 complaints in the previous month alone?

- Why did we lose 15% of our subscription-based customers in January?

- Why did the customer support receive a low score although we doubled the team?

- Why did we lose points on customer loyalty in a specific month?

By performing churn analysis, you keep your company away from dangerous assumptions.

You look at your churn data and you avoid constantly reprioritizing your actions based on some random tactics to reduce churn you can find online.

Instead, analyzing customer churn helps you find the root cause of your problems and make informed decisions.

You can also test the hypothesis, see how customers engage, and measure the impact of your test before implementing a tactic on a larger scale.

High churn rates indicate that you should make improving customer retention strategies your top priority.

Only by increasing the retention and the overall Customer Lifetime Value, you can produce the necessary budget to secure your business’s future growth and finance your acquisition campaigns.

> Read more about how you can prevent and stop churn.

Challenges of Churn Analysis

In their effort to understand and prevent churn, companies choose a predictive churn model for churn analysis. These churn models use existing customer and eCommerce data to help you predict future churn evolution and identify what your teams have to do to prevent it.

As helpful as it is, churn analysis can also be challenging because:

You need someone that can see beyond numbers

You could have multiple loyal and engaged customers that purchase from you frequently and regularly, but some of them suddenly stop buying from you.

Sometimes, the truth behind customer attrition lies in their negative feedback or customer support tickets. Not everything your customers say and do can be measured and further contribute to reducing customer churn.

One of the challenges of churn analysis is that you need accurate, updated data and someone that can see beyond numbers.

Raw numbers won’t help you understand customer behavior, so you need to mix quantitative and qualitative data. While it can take a lot of time and resources, it will definitely cost you less than ignoring rising churn rates.

You need a unified view of customer data

If you’re not using a customer data platform that automatically aggregates your data, it will be tough to gather data manually and get accurate results.

Having all the data in one place is important for any analysis you perform for your store, including cohort analysis or customer segmentation analysis.

A tool that unifies customer data is fundamental for optimizing customer experiences, which plays a critical role in the success of your customer retention strategy.

You can’t identify the problems without complete and updated data and take the proper measures to prevent churn.

It applies to all types of churn you’re measuring.

> Haven’t found your ideal platform yet? Take a look at Reveal – the first platform focused on increasing Customer Lifetime Value.

Book a Demo for free and invest 15 minutes of your time in learning how to earn more from your customers.

You need continuous monitoring of customer behavior

For effective churn analysis, you need to cover all the leading churn indicators that apply to your business.

Some are historical metrics, like purchase frequency, recency, or monetary value. Others are predictive metrics, including here Net Promoter Score of Customer Effort Score.

Using customer behavior segmentation like RFM segmentation can help you a lot in analyzing churn because it helps you identify at-risk customers and create the right prevention campaigns for this segment.

But it would be even better if you mix behavior segmentation with customer satisfaction metrics to keep a proactive approach. Otherwise, you will only react when the customers’ trust is already decreasing.

It might take some time until you identify all the metrics that help you evaluate churn and design an effective churn analysis model. Still, your company needs to perform this analysis regularly to stay aware of the “why” behind your churn rates.

Wrap up

Although churn rate is a leading indicator, analyzing it can help you reveal problems that your teams didn’t notice while evaluating the performance of particular campaigns or strategies.

Customer churn analysis plays a critical role in finding the reasons behind relationships that end too soon, after only one purchase, or too sudden, ending a long, valuable relationship with customers that used to be loyal.

> Learn more about keeping a proactive approach and maintaining churn rates at the lowest level possible by joining our world-renowned instructors in CVO Academy.

FAQ about Customer Churn Analysis

How do you explain why customers churn?

To explain why customer churn, you need to perform a customer churn analysis, which helps you understand the causes that determined your customer to leave. Their motivation and reasons remain often uncovered, but churn analysis enables you to get to the sources of your problems.

How is the churn rate calculated?

To calculate the churn rate, you have to divide the number of customers lost during the analysed period by the number of customers you had at the beginning of the same period, and multiply it by 100. Calculate churn rate as often as possible depending on the product types you’re selling.

How do you predict if a customer will churn?

To predict if a customer will churn, you have to constantly monitor the leading indicators of churn, including purchase frequency, customer satisfaction scores, engagement metrics, or reviews.